Understanding Insurance: Basic Terms and Definitions

Auto insurance serves as a safety net for drivers, helping to provide financial protection in the event of accidents, theft, or other unforeseen circumstances. In this article, we'll delve into some important basics of auto insurance, from reviewing its significance to deciphering policy terms. We’ll also explore ways to save on premiums.

The importance of auto insurance

Auto insurance is not just a legal requirement in most states; it's a fundamental aspect of responsible vehicle ownership. Here's why it matters:

- Financial Protection: Accidents can result in significant expenses which can lead to losses, including vehicle repair costs, medical bills, and legal fees. Auto insurance helps mitigate these risks by helping to cover such expenses, thereby helping to safeguard your finances.

- Legal compliance: In most states, driving without car insurance is illegal and can lead to fines, license suspension, or even legal action. Maintaining valid auto insurance ensures compliance with legal requirements and helps to protect you from potential penalties.

- Peace of mind: Knowing that you've purchased insurance provides peace of mind while driving. Whether it's a minor fender bender or a major collision, having insurance can alleviate the stress of dealing with unexpected expenses.

Types of auto insurance coverage

Auto insurance policies typically consist of several types of coverage, each serving a specific purpose. Understanding these coverages is essential for selecting the right policy for your needs. Here are the different types of auto insurance coverage and some general definitions:

- Liability insurance: Liability insurance helps cover property damages and the cost of medical treatment for those who are injured when you are deemed at fault for an accident. It typically includes bodily injury liability and property damage liability components.

- Collision coverage: Collision coverage helps pay for damages to your vehicle resulting from collisions with other vehicles or objects, regardless of fault.

- Comprehensive coverage: Comprehensive coverage helps protect your vehicle against non-collision incidents, such as theft, vandalism, or fire.

- Personal injury protection (PIP): PIP helps cover medical expenses and lost wages for you and your passengers, regardless of fault.

- Uninsured/underinsured motorist coverage: This coverage can be extended if you're involved in an accident with a driver who lacks sufficient insurance coverage or is uninsured altogether.

- Medical payments coverage: MedPay, as it’s sometimes called, helps cover medical expenses for you and your passengers, regardless of fault.

- Gap insurance: Gap insurance helps cover the difference between the actual cash value of your vehicle and the amount you owe on your auto loan or lease if your vehicle is totaled.

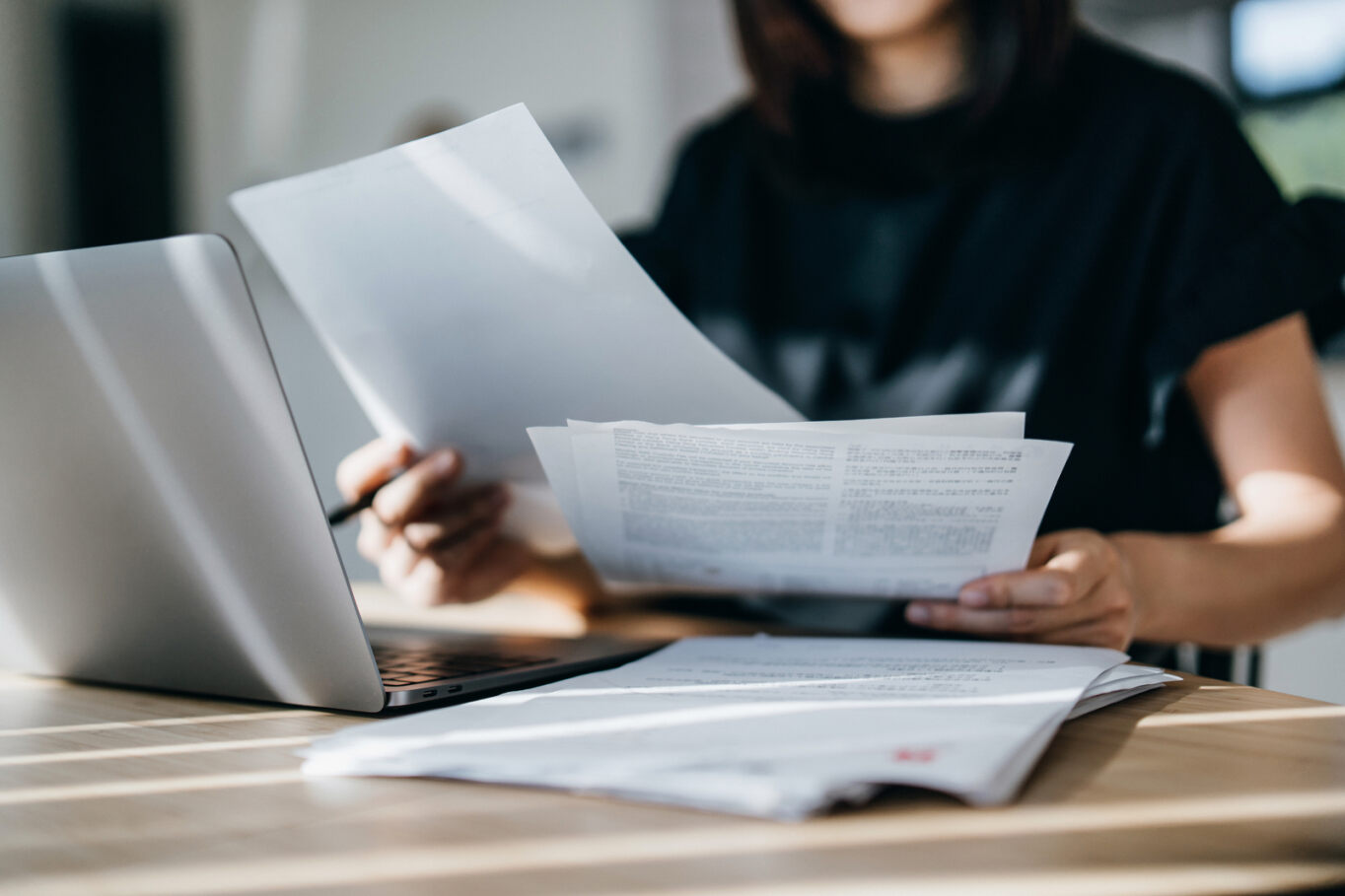

Deciphering auto insurance terminology

Some auto insurance terminology may be unfamiliar to the average consumer. Familiarizing yourself with these terms can help you better understand your policy and make informed decisions. Here's a small glossary of common auto insurance terms:

- Deductible The amount you're responsible for paying out of pocket before certain insurance coverage kicks in.

- Premium: The cost of your insurance policy, typically paid monthly, quarterly, or annually.

- Policy limits: The maximum amount your insurance company will pay for covered losses.

- Exclusion: Items or situations not covered by your insurance policy.

- Endorsement: A modification or addition to your insurance policy that alters its terms or coverage and possibly the cost of the policy.

- Underwriting The process by which insurance companies evaluate and determine the risk associated with insuring a particular individual or vehicle.

- Claims adjusterClaims Adjuster: An individual employed by an insurance company to assess and process insurance claims.

- Endorsement/Rider: An optional add-on to your insurance policy that provides additional coverage for specific risks.

Tips for saving on auto insurance

While auto insurance is essential, nobody wants to pay more than necessary for coverage. Here are some strategies for saving on your auto insurance premiums:

- Shop around: Compare quotes from multiple insurance providers to find the most competitive rates. Each insurer evaluates risk differently, so prices may vary.

- Bundle policies: Many insurers offer discounts for bundling auto insurance with other policies, such as homeowners or renters’ insurance.

- Maintain a good driving record: Avoiding accidents and traffic violations can lead to lower insurance premiums. Many insurers offer discounts for safe driving.

- Increase deductibles: Opting for a higher deductible can lower your premium but be sure you can afford the out-of-pocket expense in the event of a claim.

- Take advantage of discounts: Inquire about available discounts, such as multi-vehicle discounts, safe driver discounts, or discounts for completing defensive driving courses.

- Drive less: Some insurers offer discounts for low-mileage drivers. If you don't drive frequently, be sure to mention this when obtaining quotes.

- Maintain good credit: In many states, insurers use credit scores as a factor in determining premiums. Maintaining good credit can lead to lower insurance rates.

- Choose the right vehicle: The type of vehicle you drive can impact your insurance premiums. Generally, newer, more expensive vehicles cost more to insure.

Auto insurance is a crucial aspect of responsible vehicle ownership, helps provide financial protection and peace of mind in the face of unforeseen events. By understanding the various types of auto insurance coverage, deciphering policy terms, and implementing strategies to save on premiums, you can be adequately insured without breaking the bank.

Remember, insurance needs can vary depending on factors such as driving habits, vehicle type, and personal preferences. Be sure to regularly review your policy and adjust coverage as needed to meet your evolving needs.

With the right knowledge and proactive approach, navigating the world of auto insurance can be manageable and even empowering. So, whether you're a seasoned driver or a new car owner, make informed decisions to secure the protection for your needs on the road ahead.

Disclaimer:

This material is for general informational purposes only. Products, services, and discounts referenced herein are not available in all states or in all companies. All statements are subject to the terms, exclusions, and conditions of the applicable policy. In all instances, current policy contract language prevails. Coverage is subject to individual policyholders meeting underwriting qualifications and state availability. Other terms, conditions and exclusions may apply.